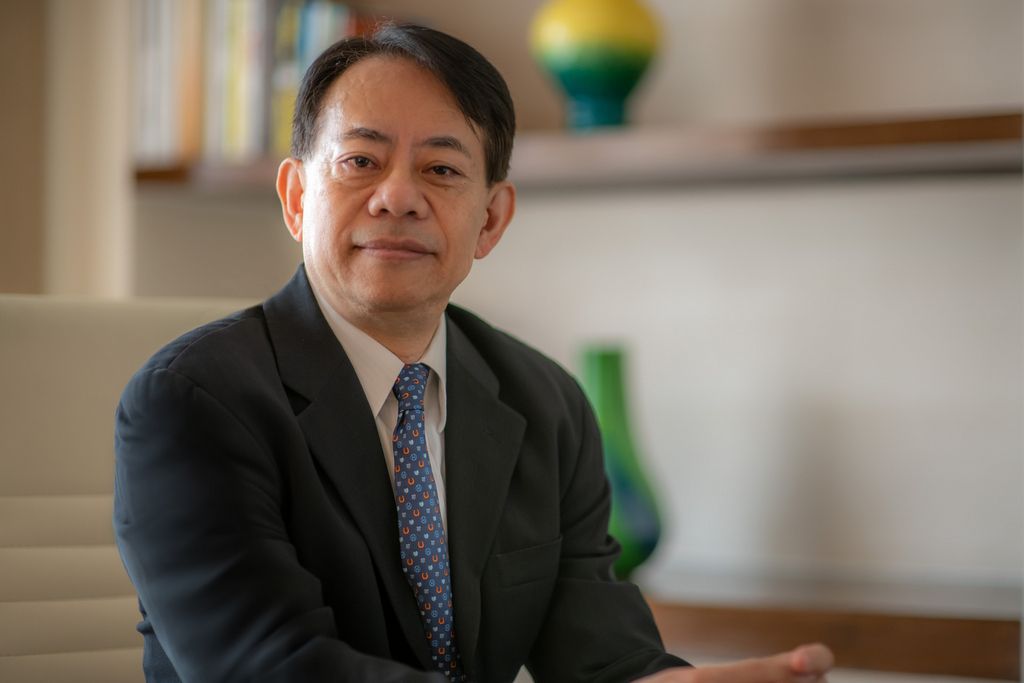

“I firmly believe that one of the keys to success in achieving the Sustainable Development Goals (SDGs) in a world reshaped by COVID-19 (coronavirus disease) will lie in strengthening domestic resource mobilization (DRM) and international tax cooperation (ITC),” said ADB President Masatsugu Asakawa in a seminar today at ADB’s 53rd Annual Meeting.

The Regional Hub on DRM and ITC will focus on promoting DRM and ITC through close collaboration among finance and tax authorities of developing economies; international organizations such as the International Monetary Fund (IMF), the Organisation for Economic Co-operation and Development (OECD), and the World Bank; and regional tax associations.

Despite many developing economies having maintained strong and steady gross domestic product (GDP) growth in recent years, tax yields have not increased proportionately. Even prior to the pandemic, many economies did not achieve a minimum tax yield of 15% of GDP—a level now widely regarded as the minimum required for sustainable development. The COVID-19 pandemic has worsened the situation due to increased pressure on economies’ expenditures and a decrease in tax revenue, leaving little room to further increase external borrowing.

Participants in the seminar discussed how governments must balance efforts to raise tax revenues and promote investments that can contribute to a robust recovery from the pandemic, and the need to earn the trust of taxpayers while seeking to increase the tax base. To improve tax yields in a fair and equitable manner, governments must also cooperate more closely, including to manage aggressive tax planning and combat tax evasion. This requires a higher level of participation in international initiatives such as the Inclusive Framework on BEPS (base erosion and profit shifting) and the Global Forum on Transparency and Exchange of Information for Tax Purposes.

The regional hub will serve multiple functions such as institutional and capacity development, including the exchange of information; knowledge sharing across partners, international financial institutions, bilateral revenue organizations, and developing economies; and collaboration and development coordination across development partners. It will be an open and inclusive platform, with a focus on South–South policy dialogue. The regional hub will seek to bring together practitioners from tax policy bodies as well as tax administration bodies of developing economies to achieve meaningful progress in tax reform.

The synergy created in this hub will ensure strong value addition and effectiveness in the implementation of necessary reforms.

In establishing the hub, ADB will also mainstream DRM and ITC in its operations such as technical assistance and policy-based lending to help governments enhance their capacity for DRM and adoption of international tax standards.

Seminar speakers included Japan Deputy Prime Minister, Minister of Finance, and Minister of State for Financial Services Taro Aso; Indonesian Minister of Finance Sri Mulyani Indrawati; IMF Director for Fiscal Affairs Department Vito Gaspar; and OECD Director of the Centre for Tax Policy and Administration Pascal Saint-Amans. New Zealand Inland Revenue Commissioner and Chief Executive Naomi Ferguson moderated the seminar.

Representatives from the World Bank, the Pacific Islands Tax Administrators Association, and the Study Group on Asian Tax Administration and Research also shared their views.

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. Established in 1966, it is owned by 68 members—49 from the region.