- Cody Plante, 30, accumulated $80,000 in student-loan debt from undergrad and grad school.

- In 2022, he moved onto a boat to help manage his finances and pay back his student loans.

- He now blogs about his life on a boat and said the advanced degree was not worth the debt.

This as-told-to essay is based on a conversation with Cody Plante, a 30-year-old remote project manager, who’s paying off his student debt by living on a boat. The following has been edited for length and clarity.

I grew up in the small town of Bradford in Vermont and had one main goal for when I became an adult: I just didn’t want to be poor. I was raised by a single mother on government assistance. Back then, it seemed like a degree in business administration would give me a high return on my investment.

I decided to attend Northern Vermont University and applied for all of the grants and scholarships I could get. I also modified my course load so I could work and graduate in five years, since I had to pay for college out of pocket. Regardless, I still had to take out a $30,000 federal student loan to afford my degree.

I graduated with a bachelor’s degree in 2016 and enrolled in the University of Vermont’s sustainable-innovation MBA program five years later. I took on an additional $50,000 in federal student-loan debt to get that degree.

Now, I work full-time as a remote project manager for Dartmouth College, but looking at the $80,000 I owe makes me see there’s no real return on the investment of these degrees.

After undergrad, I didn’t enjoy the work I did, but it brought in enough money to keep me from acquiring more debt

Once I graduated, in 2016, I decided to start my own apparel business. To make sure I had enough money to cover my expenses, I also worked as a bookkeeper for different businesses earning $20 an hour.

I enrolled in an income-driven repayment plan, which determines how much you owe on your loans every month based on your current income. I paid $121.85 a month on this plan, but I was mostly just paying off the monthly interest. The payments never made a dent in my original balance.

I ended my apparel business in 2018 and started looking into different, higher-paying careers

I took a job as a research-project coordinator for the Attention Consortium. During those four years, I continued to mostly just pay off the monthly interest on my loans.

When I enrolled in the University of Vermont’s sustainable-innovation MBA program in 2021, Princeton Review had ranked it one of the top MBAs to get into a career that addresses environmental, sustainability, or social responsibility issues. I’m passionate about sustainability and the health and future of our planet, so I didn’t want to just earn money — I wanted to do so responsibly.

Because of the COVID-19 pandemic, federal student loans went into forbearance. My loan payments are in deferment until Biden’s student-debt relief program is litigated, but when that date comes around, I’ll owe around $166.63 a month. To prepare for these payments, I’ve been working on a few ways to save money.

I drastically changed my lifestyle, moved onto a boat, and sailed to Annapolis, Maryland

When I was living in Burlington, Vermont, while in graduate school, I was paying around $900 a month for rent and utilities. After I graduated in August 2022, I wanted to significantly reduce my cost of living, so I purchased a 1989 Passport 41 sailboat from my family for $50,000, and I live full-time on the boat.

I used my $20,000 savings and took out a $30,000 loan from the boat owner to purchase it. I pay $340 a month on that loan, but I plan to sell the boat in five years for a reasonable return. Living on a boat has expenses, but I think there’s a financial upside if you look at the whole picture on a 5-year time horizon.

I started docking my boat for $328 a month, which is far less than what I was paying in rent. Eventually, I upgraded to docking my boat for $656 a month to protect it from the elements. As I travel further south, I find more affordable docking rates; my next destination is South Carolina. I’m currently seeking marinas that will cost $8 to $11 per foot each month — my boat is 41 feet.

When I don’t want to pay for docking, I anchor my boat off the coast for free. Other than that, my electricity, maintenance, and additional expenses come out to a few hundred dollars a month. Insurance is a little over $2,000 annually, and I know how to do my own boat maintenance because I was a deckhand, helping to maintain and move boats, for years.

I can go stir crazy because of the lack of space, but the best way to avoid spending money is to stay on the boat

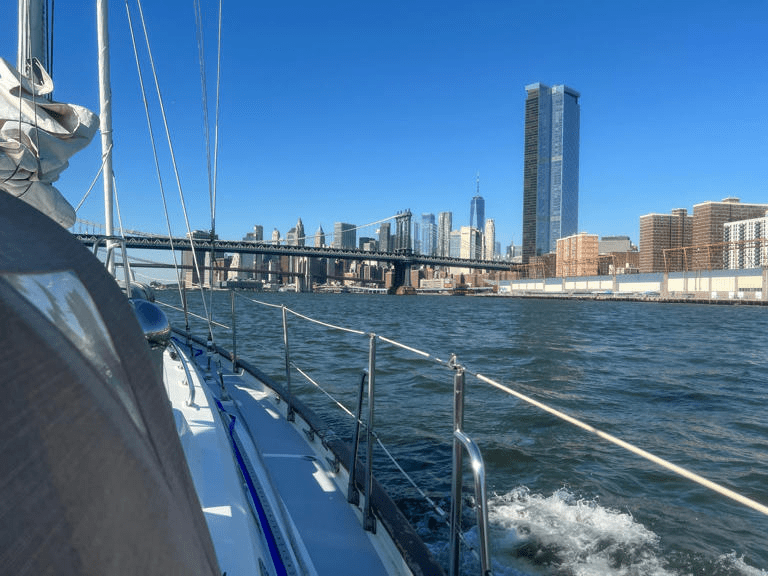

During the summer, I spent about one month at anchor, where I only dinghied to shore three times. I’ve traveled off the shores of Rhode Island, Connecticut, New Jersey, New York, Maryland, and Virginia. I didn’t pay anything to anchor, but the tradeoff was staying on the boat longer. I’m currently at a dock and I leave the boat at least once a day — even if I just walk around a short while.

Also, I have a bike instead of a car, so I don’t have to pay for car insurance, gas, or the maintenance expenses that come with having a vehicle. I try to eat as many meals as I can on the boat to help save money.

The confined space and small appliances and storage areas reduce waste. I can’t cook as big of batches and I can’t store a lot of food. You become cognizant of your consumption, and perhaps frugality is an unintended benefit of that.

I’ve started looking for additional work

I’m always looking for ways to add new streams of income, so in addition to brainstorming other jobs I can take on, I’m trying to make passive income through my sailing blog, which I spend 15 hours a week working on and started three months ago.

I try to focus on ad-based revenue, which is based on how many views my website gets, but building that up has been slow. I’m hoping that within six months to a year, I can monetize my blog to bring in enough cash every month to cover part of my monthly student-loan payments.

I’ve also started freelancing as an analyst providing research services to companies. I speak to companies that use certain softwares to find out what pain points they’re experiencing and report that data. This is a side hustle that a friend shared with me. Outside of working 40 hours at my full-time job, I put in eight hours a week freelancing.

It feels impossible to know when I’ll fully pay off these loans

It’s hard to know what the labor market is going to look like. My main plan was to cut back on my cost-of-living and work remotely, but so many remote jobs are disappearing. I feel like paying off these loans relies on circumstances that are out of my control. My personal goal is to pay my student loans off in 10 years, but if I don’t begin to increase my income, I may die with some debt.

If I could go back and do it all over, I wouldn’t get a graduate degree. I was encouraged to do it by the businesses and folks I was doing bookkeeping for, but I didn’t see a payback from it and don’t know if I ever will. I don’t like the financial burden it’s placed on me.

Instead of getting a graduate degree, I would’ve educated myself by reading different materials, networking on my own, and learning through real-life job experiences. I now know that a lot of the skills needed to do well in business come from learning on the job.