Janet Yellen Reveals Her Plans for Cryptocurrencies

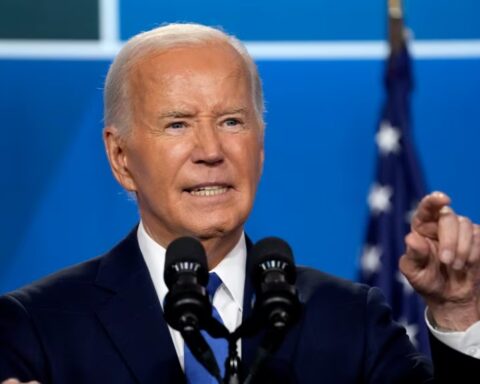

In the Senate hearing to consider Janet Yellen’s nomination as Secretary of the Treasury on Tuesday, Yellen was asked about cryptocurrencies. She is Joe Biden’s pick to lead the Treasury Department under his administration.

The crypto question was asked by Senator Maggie Hassan (D-NH), who talked about “the importance of treasury programs to combat the financing of terrorists and criminal organizations.” She said she had raised the issue in previous hearings with Treasury Secretary Steven Mnuchin.

“The bipartisan National Defense Authorization Act passed earlier this month and it included a provision led by Senator Warner that established an advisory group with Treasury to counter new ways that terrorists use emerging financial technology,” she began. “One area of growing concern, for example, is the potential for terrorists and criminals to use cryptocurrency to finance their activities.”

Senator Hassan proceeded with her question: “So Dr. Yellen, can you outline some of these emerging technological concerns and how Treasury should combat new forms of terrorists and criminal financing?”

Yellen replied: “Senator, I think you are absolutely right that the technologies to accomplish this change over time and we need to make sure that our methods for dealing with these matters with tech terrorists financing change along with changing technology.” The incoming Treasury Secretary elaborated:

Cryptocurrencies are a particular concern. I think many are used, at least in a transactions sense, mainly for illicit financing and I think we really need to examine ways in which we can curtail their use and make sure that anti-money laundering (sic) doesn’t occur through those channels.

Bitcoiners React to Yellen’s Remarks

Following Yellen’s Senate testimony, the crypto community pointed out several flaws in her statements. Russell Okung, the pro football star who recently became the first NFL player to get paid in bitcoin, commented: “Treasury Sec nominee Yellen says bitcoin is a concern for terrorist financing, money laundering … as if the USD isn’t. Don’t be distracted. The things of old are passing away, fight for your future.”

Dan Held, Growth Lead at crypto exchange Kraken, pointed out: “0.3% of all cryptocurrency activity in 2020 was illicit. 90% of US dollars have cocaine on them. Which one is ‘used by the bad guys’ again?”

Morgan Creek Digital partner Anthony Pompliano similarly described: “Janet Yellen stated today that cryptocurrencies are concerning because of terrorist financing and money laundering. She forgot to mention that the US dollar is the choice currency of criminals around the world.” He added:

The large banks launder more money than the entire bitcoin market cap.

Some people referenced the “bitcoin sign guy,” who rose to fame when he held up a sign that says “buy bitcoin” behind Yellen as she testified in a previous Senate hearing as the Federal Reserve chairman. Perhaps she “missed the sign,” some bitcoiners suggested. Ivan on Tech tweeted Wednesday: “Janet Yellen promises to go after bitcoin in a recent interview. She is still salty for that bitcoin sign incident.”

Yellen is not the only one suggesting recently that most crypto activities are for illicit purposes. Last week, the president of the European Central Bank (ECB), Christine Lagarde, said that bitcoin “has conducted some funny business and some interesting and totally reprehensible money laundering activity.” However, a famous economist quickly contradicted her, calling the ECB chief’s statement “absolutely outrageous when we all know that the vast majority of money laundering globally is conducted in fiat currencies, particularly in U.S. dollars and euros.”

Source: bitcoin.com