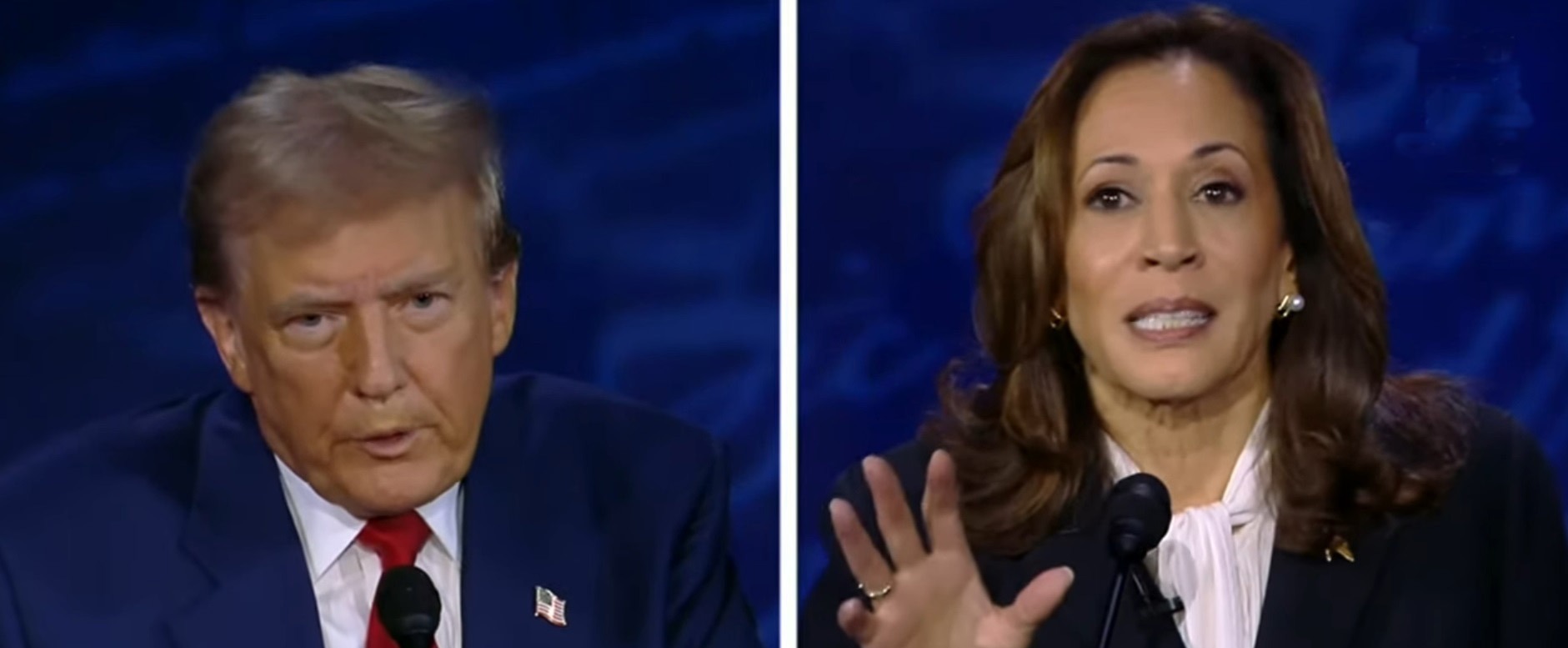

In the final weeks of 2024’s election campaign, Presidential preference polls remain close, making it difficult to predict the outcome. -ELECTIONS AFFECT THE US ECONOMY -Democratic nominee, Vice President Kamala Harris, and Republican nominee, former President Donald Trump, appear to be running neck-and-neck in both national polls as well as in key “battleground state” voter surveys.

The election landscape changed in July when President Joe Biden opted not to seek a second term. “This is no longer an election that is directly a referendum on an incumbent,” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. “Market uncertainty often centers around whether an incumbent will lose, but come January 2025, we know there’s going to be a change of president one way or the other.”

We’ll have to wait to find out how much this cycle cost, but spending from outside groups is already on track to break records.

Election spending lifts some parts of the economy, keeping local newsrooms afloat and creating temporary jobs that support a politician’s campaign. But all those billions don’t add up to a noticeable impact on the U.S. economy overall, experts told us.

Campaigns will buy up advertising on television and radio, because that’s where they can reach most committed voters, said Robin Kolodny, a political science professor at Temple University.

Older voters reliably watch the 5:30 news, the 6 o’clock news and the 11 o’clock news, all of which air with wall-to-wall campaign ads.

“When you are doing political advertising, what you really want to be matched with is the appropriate audience,” Kolodny said. “There’s a reason you don’t see a lot of political ads on ‘American Idol’ or ‘Dancing with the Stars.’ A whole lot of nonvoters are likely consumers of that.”

Vice President Kamala Harris and former President Donald Trump, along with various allies and super PACs supporting them, are planning to spend a combined $500 million on radio and TV during the final two months of the campaign, the New York Times reported.

A decent chunk of change also goes toward digital advertising. For the 2020 election cycle, President Joe Biden spent a total of about $192 million in online ads, while Trump spent more than $268 million.

On the campaign trail, presidential hopefuls visit local shops, restaurants and hotels, giving them a sales boost,

Local print shops also benefit by whipping up campaign materials.

But all those diner visits, TV ads and yard signs only add up to about 0.06% of U.S. economic output. While campaigns and their donors spent more than $14 billion during the last presidential election, 2020’s fourth quarter GDP stood at $22 trillion.

One of the most significant impacts of election years on the economy is the heightened level of policy uncertainty. Investors, businesses, and consumers are often unsure about future government policies, which can lead to market volatility. Financial markets tend to react to election-related news, with stock prices fluctuating based on the perceived chances of different candidates and their proposed policies.

These fluctuations are typically positive. From 1928 to 2016 there were 23 election years and 83% of them saw positive S&P 500 performance.3 The four years that saw negative performance coincided with economic events like the Great Depression, the start of World War II, and the 2008 housing market crash.

Often, elections lead to changes in government spending and fiscal policies. Incumbent governments, which are those currently holding office, may increase spending on public projects and social programs to garner voter support. Conversely, the anticipation of new administrations can result in shifts in fiscal priorities, affecting various sectors of the economy.

Successfully predicting election outcomes is difficult. Over the last decade, pollsters, political analysts and reporters have made some notable forecasting errors.

One clear example is the 2016 US presidential election.

One of the most significant impacts of election years on the economy is the heightened level of policy uncertainty. Investors, businesses, and consumers are often unsure about future government policies, which can lead to market volatility.

Financial markets reflect this challenge. In the absence of a clear consensus about the outcome, we see larger daily price changes that tend to offset each other. While these leave prices unchanged overall, they create amplified market fluctuations over the election period.

This difficulty is evident in the heightened volatility of share prices during elections. One study finds that within the 50 days surrounding elections, stock market returns exhibit more than 20% higher volatility than anticipated.

Consumer sentiment

Consumer sentiment plays a crucial role in economic performance. While election cycles can be anxiety-inducing, the event itself doesn’t always correlate with lower consumer sentiment. Studies actually suggest party affiliation is what affects consumer sentiment and spending after an election.4 If your candidate loses, you may feel more pessimistic about the future and delay major purchases or increase savings. If they win, you may feel more optimistic about both personal and national economic conditions.

Business investment and planning

Businesses also adjust their strategies in response to election-related uncertainties. Companies may postpone investment decisions, expansion plans, and hiring until there is more clarity about future policies and economic conditions.

Is there no effect?

While the evidence may not support election outcomes having a long-term impact on the stock market, the same is not true for the short term. The short-term effects of national elections have been found across several studies.

The short-term effects are more acute for uncertain and delayed outcomes, such as the 2000 US presidential election. These cases are typically associated with a negative stock market reaction. The short-term effects are also more likely to be pronounced for surprise election results, as was the case with the US election result of 2016.

Do policies affect share prices?

Before an election, we have political uncertainty. This uncertainty is likely to have direct effects on the real economy, which is then reflected in stock market valuations. Evidence from the United States indicates that firms reduce investment expenditures during election years by nearly 5%. In addition, political risk affect the value of international investment in a country.

The negative stock market effects are most likely to be attributable to economic policy uncertainty affecting the real economy, with investment, industrial production and unemployment all reacting negatively.

Unemployment rate

Take the unemployment rate. It is a ratio of those seeking work to the whole active labor force. In past times, most households depended on a single earner, for whom holding a job was a make-or-break proposition. If unemployment was high – say 7% or 8%, typical in recessions – then even though 93% or 92% of the labor force was still working, fear of unemployment spread the woes of those actually out of work. But if unemployment was low, most workers felt reasonably secure. The unemployment rate, back then, was a reasonable indicator of distress or well-being.

Those days are long gone. Today’s typical American working household has several earners, sometimes in multiple jobs; it relies on several income streams to make ends meet. But if one earner loses a job, while the others keep theirs, she may not return urgently to the workforce; there is the option of making do with less, and for some there is early retirement. She will not, in that case, count as unemployed. A low jobless rate can mask a great deal of stress in such households. The employment-to-population ratio is still a bit below where it was in 2020, and far below where it was in 2000.

Inflation

Next, consider inflation. Inflation is the rate of price change measured month-to-month or year-to-year. But what matters to consumers is prices in relation to household incomes over several years. In 1980 Ronald Reagan asked, “Are you better off than you were four years ago?” Today, there is no doubt that millions of American households – perhaps not most, but many – are worse off than they were in 2020. Basic living costs, such as gasoline, utilities, food and housing, have risen more than incomes have. Real median household income peaked in 2019 and fell at least through 2022.

Yes, but did real wages not go up sharply in 2023? According to the Biden-friendly Center for American Progress, real wages (for those continuously employed) have now recovered roughly to where they would have been had no pandemic occurred.3 But there is a great distinction between steady progress and a sawtooth down-and-up. The former breeds confidence; the latter does not.

Then there is the deep question of job security. In the golden years during which today’s older generation of economists learned their textbook tools, a worker’s job was often a lifetime affair. Autoworkers (and their associates in rubber and glass) might suffer periodic layoffs, but they could expect to be called back; their skills and experience remained useful. That was all over by the 1980s.

Since then, factories have closed and have not returned, and practically all new jobs have been in routine services, with mediocre wages and high turnover. The pandemic drove home the fragility of these jobs to everyone, even those who had never lost a job before.

Interest rates

Interest rates are another big problem. Long ago Joe Biden kicked the can of “fighting inflation” over to the Federal Reserve. The Federal Reserve then did the only thing it knows how to do: it hiked interest rates. Mortgage rates were around 3% in 2021; today they are at least twice that. High interest rates hit young families looking for their first house, and they hit established households, often older, looking to sell their homes. The capital wealth of the middle class falls, to the benefit of those with cash to spare. The second group is much smaller and far richer than the first.

For the politically and economically alert, high interest rates bring other anxieties. Although conditions may have changed, they are traditional harbingers of financial crisis and recession. And in the peculiar world of budget projections, they blow up forecasts of future federal budget deficits and debt, provoking scare stories and stoking campaigns to cut Social Security, Medicare and Medicaid – the bulwarks of middle American social insurance.

Changing electoral dynamics

While the presidential contest’s dimensions have changed, what’s not clear is what the implications could be down the ballot, particularly with House and Senate races that will determine Congressional control.

Along with the headline presidential race, one-third of the seats in the U.S. Senate (currently under narrow Democratic control) and all 435 seats in the U.S. House of Representatives (currently under narrow Republican control) are also on the ballot this fall. Here, too, a small margin may determine control beginning in 2025, with winners in many closely contested seats difficult to predict. It is conceivable that the election outcome could result in one-party control of both houses of Congress and the presidency, or a split between the two parties, as exists today.

“A key consideration for investors would be the policy direction of the winning candidate,”

“The biggest policy advancements occur when one party controls the White House and both houses of Congress. Based on polls, we’re a long way from that scenario at this point.”

Projecting the outcome

National polls recently gave a slight edge to Harris, but don’t accurately reflect the impact of electoral college nuances. The plots shown here provide an average of national polls, with the 30-day average aggregating each candidate’s percentage of respondents intending to vote for respective candidates.

Prediction markets are a recent development to assess likely election outcomes. It allows people to trade contracts reflecting expectations of specific outcomes. While Harris had built a modest advantage in recent weeks, in early October prediction markets narrowed to a virtual tie.

Harris & Trump

Vice President Harris has focused more specific proposals for expanded child tax credits and credits for first-time homebuyers. In the meantime, Trump recently proposed cutting the corporate tax rate to 20%, and as low as 15% for companies manufacturing products in the U.S. Both Trump and Harris have also stated support to eliminate taxes on tips for service and hospitality workers.

Other proposals have come forth as well. Harris laid out plans for the capital gains tax rate, with the top rate currently set at 20% (for the highest income earners) to be adjusted upward to 28%. Trump also supports tax deductible automobile loans, and an end to taxes on Social Security benefits, and a number of other tax breaks.

Tariffs, particularly those placed on , have emerged as a significant issue. During his term as President, Trump implemented tariffs, and President Biden continued most of them and recently added more tariffs, reflecting a move away from previous free trade policies. Trump has discussed the possibility that, if elected, he would consider implementing more significant tariffs. Either candidate as President is likely to pursue fiscal stimulus policies to boost the economy, although likely with different combinations of tax incentives and higher spending.

Party control may have more impact at the sector level. “For example, if Republicans win, there is likely to be more of a push for development of fossil fuels, while a Democratic win might further promote development.” Yet such policy tendencies don’t always translate into investment outcomes. “Ironically, businesses tied to renewable energy saw their stocks perform better under the Trump administration, while stocks of oil companies and other traditional energy companies have performed better under the Biden administration.”

How do election outcomes impact markets?

An old saying goes that “elections have consequences.” But how do those results influence ? And what are the potential ramifications for you as an investor? To better address this question, U.S. Bank investment strategists studied market data from the past 75 years and identified patterns that repeated themselves during election cycles.

The analysis points to minimal impact on financial market

performance in the medium to long term based on potential election outcomes. The data also shows that market returns are typically more dependent on economic and trends rather than election results.

What may be more important to investors is what the parties represent. “Party platforms, which are hammered out at national conventions, often tell the markets more important information than the name of the winner or loser of the general election,” says Haworth. “Investors will try to determine which party is likely to be in power, and how that will benefit particular industry sectors of the market.”

A historical look at presidential elections’ impact on the stock market

U.S. Bank investment strategists reviewed market data going back to 1948. Using average 3-month returns following each election outcome—and comparing those with the average 3-month return during the full analysis history—strategists calculated the statistical significance of the relationship between political control and market performance using a calculation called a t-statistic, or t-test.

A t-test determines whether one group of variables (in this case, the political composition of the White House and Congress) has a measurable effect on another variable (in this case, average three-month S&P 500* returns during the control period).

The analysis also looked at the exact periods of time when parties took control of different branches of government (rather than starting from election dates themselves), although this analysis resulted in similar outputs and conclusions.

Results of the analysis contradict conventional wisdom that a Republican or Democratic “sweep” of the presidency and Congress is most likely to cause market disruption. In fact, historically there has not been a statistically significant relationship between single-party control of both the White House and Congress and market performance.

Rather, the data uncovered three divided-government outcomes with a statistically significant relationship to market performance.

Two scenarios corresponded to positive absolute returns in excess of long-term average returns:

Democratic control of the White House and full Republican control of Congress.

Democratic control of the White House and split party control of the Senate and House.

One scenario corresponded to positive absolute returns modestly below long-term average:

Republican control of the White House and full Democratic control of Congress.

Historical economic and inflation trends and market performance

While investors may closely monitor election results for their potential effect on stock market performance, it’s important to recognize that other factors that may have greater impact on their portfolios. The historical data suggests that economic and inflation trends, more so than election outcomes, tend to have a stronger, more consistent relationship with market returns.

The historical data suggests that economic and inflation trends, more so than election outcomes, tend to have a stronger, more consistent relationship with market returns.

In general, rising economic growth and falling inflation have been associated with returns that are considered above long-term averages, while falling growth and rising inflation have corresponded to positive but below average market returns. For investors, staying focused on these patterns is probably more insightful than potential election outcomes when it comes to forecasting market performance.

Why do stock markets care?

The link between elections and the economy has been known for a long time. Politicians often boost the economy before elections to gain favour, only to follow up with tough measures like inflation control via higher interest rates afterwards.

There is some evidence to suggest that it is not just the timing of elections that affect stock markets but that the outcomes matter too. Contrary to the assumption that Wall Street prefers Republican presidencies, evidence suggests that stock markets historically perform better during Democratic presidencies

Stock market performance in midterm election years

When looking at midterm election data (elections held in between presidential elections), U.S. Bank investment strategists found that the S&P 500 consistently outperformed in the year after midterms compared with non-midterm years. Just like presidential elections, which party controls Congress generally was not a factor in projecting overall equity market performance.

These and market trends were consistent over time unless there was a dramatic disruption. Read more about .

Specific stock market sectors and key policy issues to watch in election years

While the analysis doesn’t point to elections having a meaningful medium-to-long-term market impact, they could affect individual sectors and industries. Different election outcomes have the potential to affect proposed policies, regulations, or global conflicts.

By Mamuka Phochkhua

With reporting by usbank, marketplace.org, intereconomics.eu,