Open finance is set to change the future of the Swiss financial center and will play a key role in both established and new business models. Over the past few years, Swisscom and SIX have each developed open finance solutions that create opportunities for companies. Swisscom has focused on integration, while SIX has specialized in a uniform participation contract and in structured and standardized auditing of third-party providers.

Through the technical cooperation the two companies to increase the compatibility of their hubs to offer the market an interoperable and holistic end-to-end solution for the implementation of open value networks in the open finance context.

Cooperation Brings Further Standardization and Interoperability

Through their cooperation, SIX and Swisscom are addressing two key challenges: the lack of standardization when it comes to integrating third-party providers into the systems of financial services providers, and the inability to connect multiple third-party providers for the same use case in a scalable manner.

Swisscom offers an integration layer to support this, which companies can use to connect their systems efficiently with Swisscom’s Open Business Hub (OBH) – and in the future, therefore, with bLink of SIX as well. The Swisscom OBH is also supplementing its offering with the bLink digital consent management tool, which handles the technical process via which end-customers give consent for their data to be used. In this cooperation, bLink takes care of the standardized verification and connection of third-party providers.

The medium-term goal is for Swisscom and SIX to further strengthen interoperability between their respective hubs. This will give banks and third-party providers easy and standardized access to an even broader network of potential partners from the financial industry and beyond.

Both companies are certain that open finance is making a decisive contribution to the formation of ecosystems through standardization and scaling. By joining forces, they are creating the basis for simplifying cooperation and interoperability within the Swiss financial center and thus promoting the competitiveness and innovative capacity of Swiss financial actors over the long term.

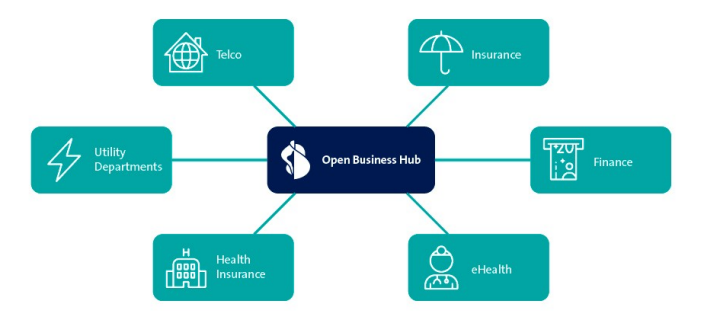

Swisscom Open Business Hub

As a specialist operator and integrator of core and peripheral systems, Swisscom has been connecting providers and users of financial services for many years by means of application programming interfaces (APIs). The OBH aims to create cross-industry (finance, insurance, telecommunications, eHealth, health insurance, utility departments, etc.) business API ecosystems in order to simplify processes and unlock additional value. More than 30 companies are currently connected via the Swisscom integration layer, an element of the OBH. For example, the TWINT white label API connection to over 18 banks with different identity and access management (IAM) solutions and core systems runs via the Swisscom integration layer.

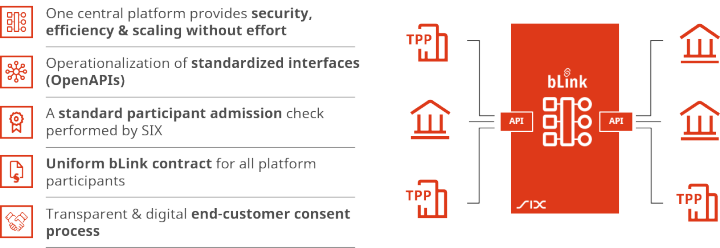

bLink of SIX

bLink of SIX is the open banking solution developed for the Swiss financial center. Financial institutions and third-party providers can connect with each other easily and securely via the central platform and exchange data-based services. With its standardized overall package, bLink creates all the prerequisites for forming successful partnerships and comprehensive ecosystems: a uniform contract rather than individual agreements ensures greater efficiency, a standardized admission test for third-party providers ensures maximum security, digital consent management ensures full transparency for end-customers, and modern interfaces (APIs) ensure reliable technical connectivity. UBS, Credit Suisse and Zürcher Kantonalbank are among the first financial institutions to get connected.

With bLink, SIX lays the foundations for Open Banking in Switzerland