Introduction

Pakistan is facing a chronic energy crisis. A fragile distribution system, electricity demand–supply mismatch, and reliance on fuel oil, coupled with a shortage of inexpensive domestic gas supplies, have led to massive power outages or long hours of load shedding.

One of the measures taken by the Government of Pakistan is to pay for the difference between the tariff charged to customers and the cost-recovery tariff on power distribution companies through a tariff differential subsidy. This is expected to also safeguard the masses against the increasing generation cost of electricity.

However, the lack of sufficient financial resources in the sector and the government’s delayed or incomplete payment of this subsidy have led to welfare loss and the accumulation of the circular debt.

There is a need to rethink the policies behind this kind of subsidy to make sure that it helps solve, and not aggravate, the energy dilemma in Pakistan.

Electricity Crisis in Pakistan

One of the factors responsible for the long hours of power outages in the country is the power sector’s dependence on expensive fuel oil as energy resource. The cost of producing electricity from fuel oil is about 16 Pakistan rupees (PRs) or $0.10 per kilowatt-hour (kWh). This does not include yet the cost of transmission losses.

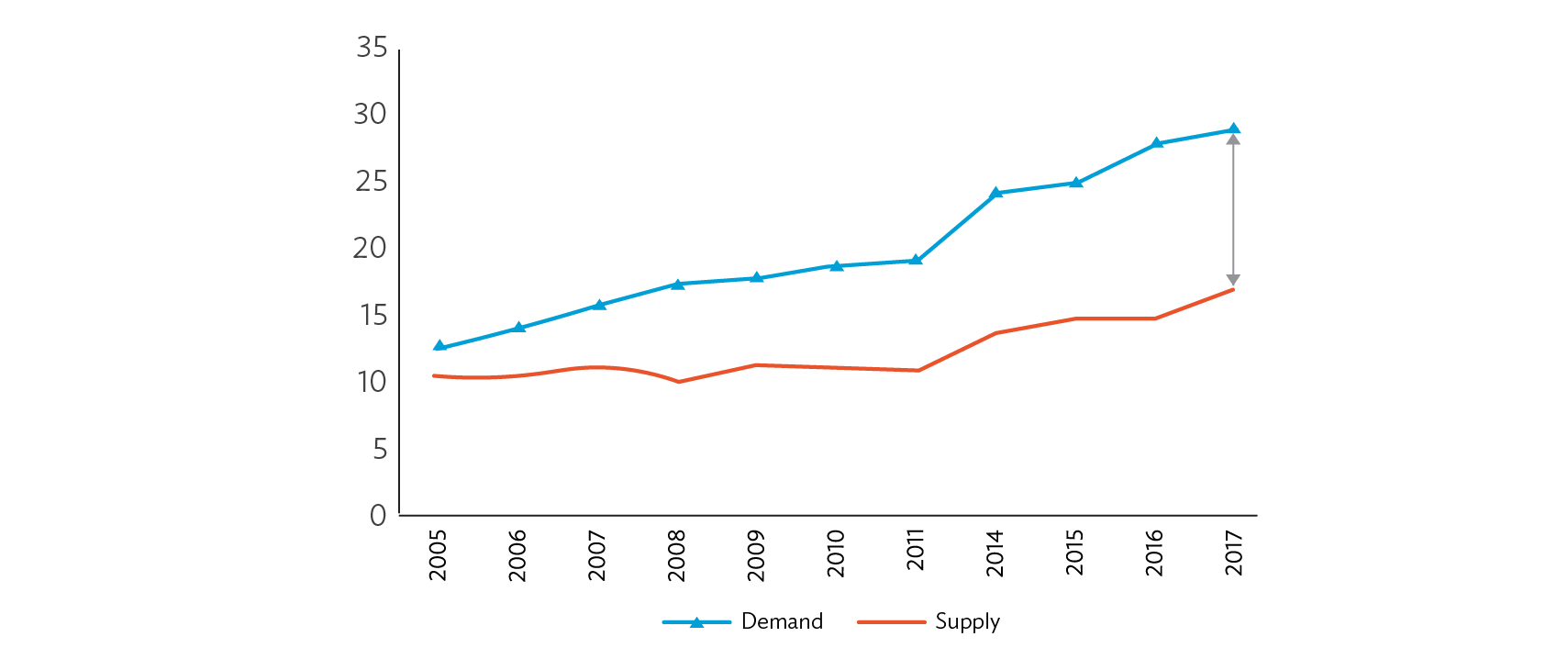

Given the limited energy supply, the rising energy demand has made it difficult for the government to control the energy crisis for a sustained period. Aside from poor governance, natural factors like population increase and resource depletion at a consistent rate contribute to the energy demand–supply mismatch.

Electricity Demand and Supply Gap in Pakistan

Source: Pakistan Energy Yearbook 2018

In recent years, electricity generation has shrunk by 50%, leading to a supply shortage. A fragile distribution system and lack of efficient infrastructure also led to as high as 17.4% transmission and distribution losses from the net supply, thus aggravating the mismatch at an alarming level. Currently, with 22,797 MW of total installed capacity, only 9000–10,000 MW is produced. As a result, the peak demand of 15,000 MV results in 10–12 hours of load shedding in some parts of the country.

Impact of Tariff Differential Subsidy

The government implemented the tariff differential subsidy policy to protect the consumers from the high cost of generating electricity. The National Electric Power Regulatory Authority (NEPRA), an independent regulator of the electricity subsector in the country, determines cost-recovery tariffs based on targets of system losses and collection rates. Based on these NEPRA-determined tariffs, the government sets end-customer tariffs, which are lower than the prices determined by NEPRA. The gap between the tariffs is covered by the government in the form of subsidies to power distribution companies. These subsidies amounted to PRs289 billion ($1.89 billion) in fiscal year (FY) 2014 and PRs220 billion ($1.44 billion) in FY2015.

However, because the NEPRA-determined tariffs understate system losses and overstate revenue collection rates, the power distribution companies bear the difference between the subsidized tariffs and the actual cost of electricity supply. The financial issues in the distribution segment have led to insufficient payments to generators and fuel suppliers, resulting in lack of funds to sustain stable electricity generation and leading to routine load shedding.

Moreover, the governments delayed and incomplete payment of the subsidy to distribution companies and the deficit in electricity sales from private sector customers and from federal, provincial, and local government consumers cause liquidity issue or circular debt. It forces the generation and distribution companies to operate below capacity as they hold back upgrades of their primary energy and replacement of parts used to generate electricity. Their cash reserves are also affected, resulting in operational inefficiencies.

Policy Recommendations

Reduce or phase out tariff differential subsidies

Reduction of tariff differential subsidies lowers the fiscal deficit significantly and, thus, eases out financial hardships for the government. Money available from discounted subsidies can be transferred to oil and gas suppliers instead. This can lead to a smoother flow of finance, lower circular debt, and better energy mix.

The reduction of circular debt and achieving better financial health of state-owned energy enterprises would also increase their capacity to invest in energy infrastructure, inducing a positive cycle of profits and further investments and providing a stable supply of energy for other economic activities.

Improvement in productivity of the electricity sector has tremendous implications to the economy and welfare of poor households. It can augment electricity supply, reduce electricity prices, generate employment opportunities, and result in better wage levels for the households.

Improve subsidy targeting

The tariff differential subsidy is meant to provide relief to the poor. However, studies show that the urban rich segment of society are the largest beneficiaries of this subsidy.

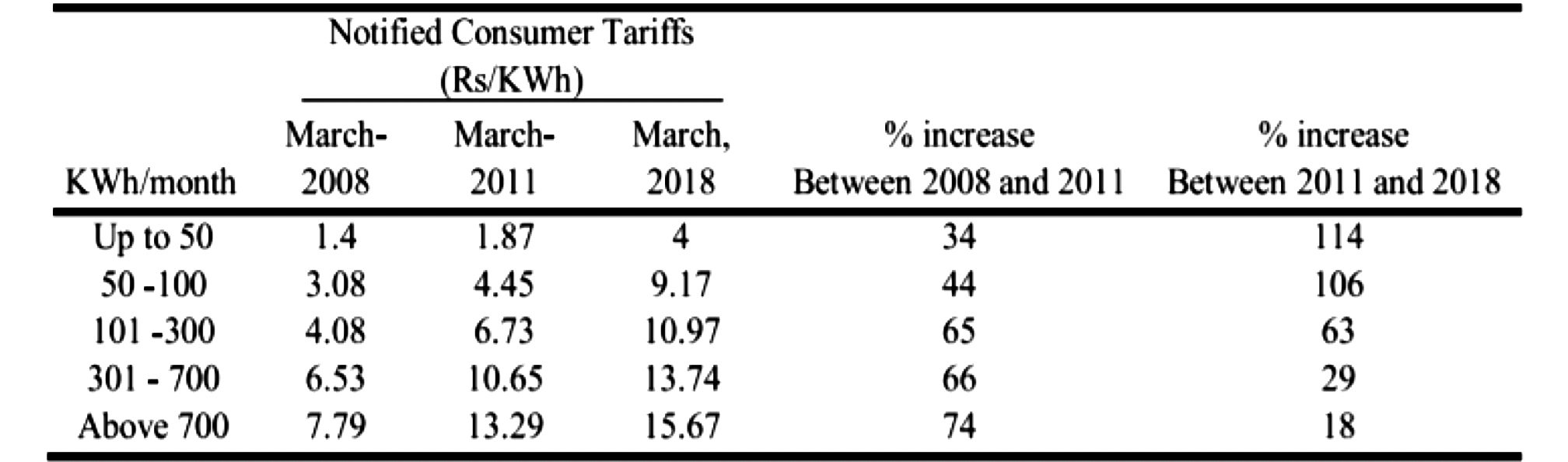

Electricity Tariff Structure for Residential Users

Source: Pakistan Electric Power Company

The tariff for households that consumes less than 50 units (slabs of monthly household consumption) increased by 114 % between 2011 and 2018. On the other hand, this substantially decreases for the households that consume relatively more electricity.

Enhance governance

The governance system and financial management of power generation and distribution companies should be enhanced. These companies should be able to contribute to achieving a better generation mix, such as improving coal mines and gas fields, and getting rid of the circular debt to avoid load shedding and improve electricity productivity.

Continued and strong political support and guidance is essential to implement significant reforms.