The American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker features state-by-state and nationwide financial performance data with breakdowns for individual gaming verticals.

Fourth Quarter & Year-End Commercial Gaming Revenue

2021 Gaming Revenue Break Previous Record, Grows $23B From 2020

U.S. commercial gaming revenue reached a record $52.99 billion in 2021. The remarkable growth was more than 21 percent higher than the previous annual record, set in 2019, and nearly 77 percent higher than 2020, when COVID-19 forced the industry into months-long shutdowns across the country.

Fourth-quarter gaming revenue was $14.31 billion, growing by 30.0 percent compared to the same period in 2019 and surpassing the previous quarterly record (Q3 2021) by 2.7 percent.

In 2021, gaming revenue expanded at a significantly faster rate than the broader economy. With U.S. economic activity growing at a 5.7 percent annualized rate, strong consumer spending on travel and entertainment powered the V-shaped recovery in gaming revenue. Despite strong personal consumer demand, lagging business and international travel, depressed conventions business, and a slower return to normal for casinos’ other amenities continued to impact the overall industry.

More than Two-Thirds of Gaming States Post New Annual Records

23 of the 34 operational commercial gaming jurisdictions—including four new markets—set records for full year commercial gaming revenue in 2021 (denoted below in bold).

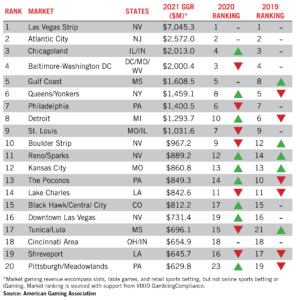

Top Casino Markets See Continued Reshuffling

In 2021, all major commercial casino gaming markets saw revenue growth over the previous year. Fourteen of the top 20 markets by gaming revenue from brick-and-mortar casinos, including slots, table games, and retail sportsbooks, also experienced a net gain compared to 2019.

The lingering disruption to business brought on by the pandemic continued to shake up the top casino markets in 2021, though to a lesser extent than in 2020. Chicagoland regained the number three spot from Baltimore-Washington, D.C., while markets in Mississippi (Gulf Coast, Tunica/Lula) and Nevada (Boulder Strip, Reno/Sparks) gained the most compared to 2019, and the Poconos (PA) and Lake Charles (LA) each dropped three spots.

Increased Consumer Spending Drives New Brick-and-Mortar Record

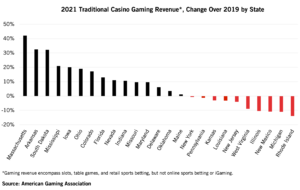

Growth in total gaming revenue was underpinned by in-person casino gaming. 2021 combined revenue from slots, table gaming, and casino sportsbooks totaled $45.62 billion, a 7.6 percent increase over 2019’s previous record.

Every market with brick-and-mortar table games, slot machines, and/or casino sports betting saw traditional gaming revenue growth over 2020, with 15 states besting 2019 numbers. Contracting states were disproportionally impacted by lingering pandemic shutdowns and operating restrictions in the first quarter of 2021, including Illinois, Michigan, Kansas, New Mexico, New York, and Pennsylvania. In Louisiana, revenue was depressed by a two-week closure as Hurricane Ida battered the New Orleans region in September and casinos in Rhode Island faced an increasingly competitive New England market.

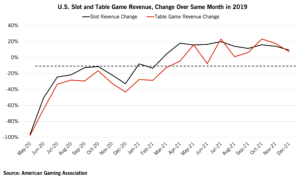

Slot revenue recovered and grew at a faster rate than table games in 2021. Slot revenue was up 10.0 percent over 2019, compared to 1.1 percent growth for table games. In many states, COVID-related regulatory restrictions limited the number of players that could be seated at any table game, with some states still suspending certain table games at the start of the year.

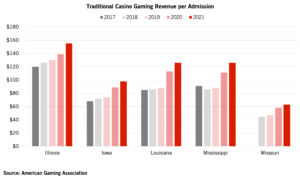

Casino Visitor Spend Reach New Heights

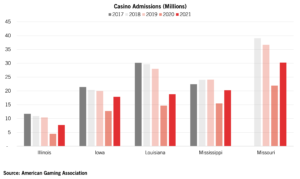

While casino visitation numbers remain depressed compared to 2019, revenue growth was driven by stronger individual consumer spending.

Casino admission data from five regional gaming states—Illinois, Iowa, Louisiana, Mississippi and Missouri—shows that spend levels remained well above pre-pandemic levels and grew from 2020. The average casino win per visitor for the five states was up between 8.9 and 13.8 percent on an annualized rate and between 19.2 and 3.2 percent from 2019 levels.

Although all five regional casino markets reported an uptick in visitation from 2020, admission numbers have yet to return to pre-pandemic levels.

Decreased visitation from 2019 levels in Iowa (-10.6%), Mississippi (-15.9%), and Missouri (-17.6%) were offset by increased spending by those who did visit casinos, resulting in overall revenue growth. However, stronger visitor spending wasn’t enough to overcome steeper admission declines in Illinois (-26.4%) and Louisiana (-32.8%), resulting in overall contraction in traditional casino gaming revenue in those markets.

Sports Betting & iGaming Accelerate

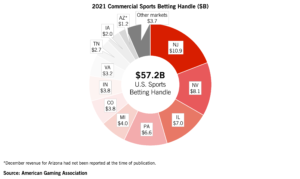

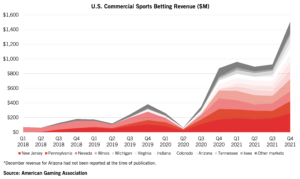

The market for legalized sports betting in the U.S. accelerated in 2021 as Americans wagered a record $57.22 billion with commercial sportsbooks, a 164.8 percent increase from 2020. Much of the increase in sports betting activity was due to the market launch in seven new commercial markets, as well as four tribal-only sports betting states. Continued market expansion across the U.S. also led to record annual wagering in 17 of 18 existing markets, including a steep surge in Michigan following the addition of legal, mobile wagering options.

Revenue from sports betting in 2021 was up 177.1 percent year-over-year, reaching an all-time high of $4.29 billion.

The busy fall sports calendar propelled legal sportsbooks to their highest-ever grossing quarter, with Q4 betting revenue surging to $1.51 billion, up 73.2 percent year-over-year and 57.2 percent from the previous record (Q1 2021).

Meanwhile, with two new markets in Connecticut and Michigan, iGaming generated $3.71 billion across six states in 2021, an increase of 138.9 percent from 2020 (excludes Nevada online poker). The fourth quarter again marked a record high, with iGaming revenue reaching $1.09 billion, jumping 124.5 percent from the same period in 2020.

Taken together, sports betting and iGaming accounted for 15 percent of 2021 commercial gaming revenue—compared to 85 percent from traditional gaming—a record share of the industry revenue picture. That’s compared to 10.3 percent in 2020, with 19 sports betting and four iGaming markets respectively. In 2019, when sports betting and iGaming were operational in 13 and three markets respectively, the two verticals generated just 3.3 percent of all commercial gaming revenue.

About the Report

AGA’s Commercial Gaming Revenue Tracker provides state-by-state and cumulative insight into the U.S. commercial gaming industry’s financial performance based on state revenue reports. This issue highlights full-year 2021 figures and Q4 2021 results.